MassTLC sat down with Ralph Dangelmaier, CEO & Board Member at BlueSnap, to learn more about BlueSnap and the FinTech industry as a whole. Read on for more in Ralph’s own words as he shares his definition of FinTech, why FinTech solutions are critical for leaders, what’s next for the industry, and more.

Please introduce yourself and BlueSnap.

I have worked in fintech for about 30 years. I started my career in banking and then went to an early stage fintech company that helped create what we called regulatory reporting for the banks in the ’90s – at the time that was a pretty big deal, and then we got on the Internet at a pretty early stage. I worked at a company called P&H where we built Internet banking products for banks to sell to businesses. We were the first business banking product online, and it was successfully sold to ACI where we helped the company grow dramatically.

I was there until about 2013, and I was seeing the eCommerce market starting to take off. I had met with companies like PayPal, Braintree, Stripe and Adyen. I thought they were doing something really cool. At that time, a group of investors had bought a company in Israel, and I thought they had a really good core concept and infrastructure. If we could take what they have and bring it to the rest of mainstream North America and Europe, I knew we’d have a real viable company and product to sell to merchants. And that company became BlueSnap.

At BlueSnap, we help merchants accept global payments online, not just with cards, but multiple payment types. And we have now pivoted to also help platforms embed payments in their software to sell to merchants. I think this the big trend for the next 10 years. We’ve designed BlueSnap’s entire global payment orchestration platform to drive results, helping businesses to reduce the costs of accepting payments while increasing their revenue. The technology is totally modular so merchants can turn functionality on and off by region, product or however they need to configure their payments.

At BlueSnap we’ve got a great team of people who really know payments that help our customers accept payments all over the world.

FinTech as an industry is accelerating quickly, and the term is often used to describe many different things. How does BlueSnap define FinTech and why do you think the industry is accelerating the way it is right now?

FinTech, or financial technology, is a hotbed for innovation. It’s constantly changing and it can be hard to keep up and understand what it means for your business. It’s a broad term that first focused on financial capabilities, then went to integrating those capabilities with non-financial experiences and now is about fully embedding financial functionality into non-financial experiences. This results in seamless experiences for end users or customers. Embedded fintech removes friction and gives people the financial services they want, when they want them and where they already are.

It’s important for all businesses to keep up with fintech and the latest trends so they don’t miss out on opportunities and get left behind.

For example, embedded finance is really a hot trend right now. Embedded finance is an umbrella term for the integration of financial services into non-financial businesses or platforms. This essentially allows businesses to offer financial services to consumers and other businesses, eliminating the need for these end users to engage with a third-party. You’re seeing embedded banking and embedded wealth management. Where BlueSnap can help, is embedded payments, and that’s where the biggest opportunity is today.

Analysts are forecasting that the total addressable market for embedded finance will be $800 billion by 2030, and $500 billion of that will be payments. BlueSnap’s embedded payments solutions allow software platforms to embed payment functionality directly within the platform, so clients do not need to integrate with another service to accept payments. Our solution gives software platforms full control over the experience, including onboarding clients as merchants, accepting payments, executing payouts and more.

How and why should leaders use FinTech as a solution within their own organizations?

In the current economy, everyone is looking for efficiencies and ROI, but what we’ve noticed is that very few companies are looking at payments this way. At BlueSnap, that is what we do.

Right now, we’re having calls with merchants and platforms that are trying to reduce costs. If you don’t have an ROI base or cost reduction-based payment platform like BlueSnap, it’s extremely difficult to move business forward. We’ve developed our platform to truly help you get the most out of payments with payment optimization.

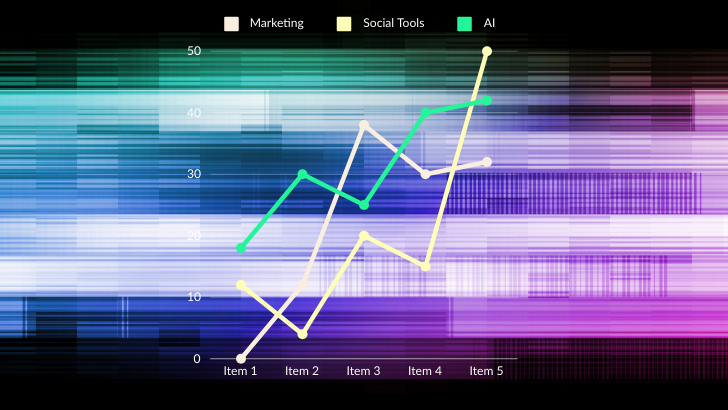

Our proprietary Intelligent Payment Routing, for example. Our artificial intelligence (AI) recognizes the card brand (Visa, MasterCard, etc.), the country where it was issued and other specifics of the transaction to automatically route the payment to the bank that is most likely to approve the transaction and charge the lowest fees. This logic is specifically helpful when it comes to failover and cross-border payments. It helps companies grow revenue by increasing successful authorizations while also ensuring the lowest costs for payments. For cross-border payments, we offer local card acquiring in 47 countries. This also helps to improve transaction approval and helps companies avoid up to an additional 2% in completely avoidable cross-border fees.

For companies that process invoices, we have our AR Automation solution, which automates the entire quote-to-cash process, helping companies to get paid faster. Valvoline implemented this solution for their fleet invoicing, and they saw an 87% decrease in their Days Sales Outstanding. This really freed their staff up to do more value-added work.

And back to embedded payments for platforms that we discussed earlier. That allows a software platform to increase their revenue per customer by up to 5X without changing their prices. Embedded payments give software platforms a new revenue stream while increasing customer loyalty and the value of the company.

FinTech is very powerful for companies of every type to use, especially in this down economy.

What’s next for FinTech and payment solutions?

To our last point, people really haven’t scratched the surface of the ROI they can expect to get from payments. We talk to merchants all the time who just look at the cost of payments as a cost of doing business. But there is so much more. How you do your payments has a direct impact on your ability to sell and bring in money. And that is something Bluesnap can help with.

Vendor consolidation is another big issue. If you are a merchant, you want to be working with as few vendors as possible. But as companies grow, we see them cobbling together payment needs, adding bits and pieces on as they need them. Maybe the first payment processor can accept US payments, and then they add on another to sell into the EU. Then you decide to add on new payment types, like digital wallets. You have to apply that to both services you’re using. Or what if regulations change? You need to make sure each individual system is compliant. With BlueSnap, it is much more simple. With one BlueSnap account, a merchant can sell into multiple regions, with redundancy and failover, because we are connected to a network of high-quality banks around the world. You can access it all through that one account.

And for our embedded payments software partners, they are the answer for their clients’ desire to consolidate vendors, too. Say you’re a student information system. In addition to scheduling and enrollment, if you can offer payment functionality to the schools as well, you have eliminated your clients’ need to work with additional vendors.

I also think the world is definitely global. Global transactions are ticking up like crazy. If you’re not figuring out how to sell or support clients globally, I think you’re missing out on opportunities. With BlueSnap, companies can easily add on new currencies and take advantage of our expertise and technology to execute in a way that will appeal to customers in the local market and then be processed for the best ROI.